Loans

Here at Kilkeel Credit Union we try our best to make sure it is as easy as possible for our members to get the loan they need.

We have 3 types of loan:

1. Loan within Shares – this allows any member to take a loan up to and including the balance of thier shares.

2. Standard loan – under £10,000

3. Standard loan – £10,000 to £40,000

Whether you’re dreaming of a new car, a boat or a truck, or a holiday, or windows – then you might be in luck!

Talk to us today about our range of monster loans. Because for all of your dreams that are big, small or strange, we’ve got you covered with our monster loan range.

Imagine – A straight-forward loan, with no sneaky conditions.

Imagine – A loan from a lender at the heart of your community.

Imagine – A loan with built in insurance, at no cost to you.

The Credit Union – Imagine More

Loan Within Shares

Standard Loan

£1 – £9999

Standard Loan

£10k – £40k

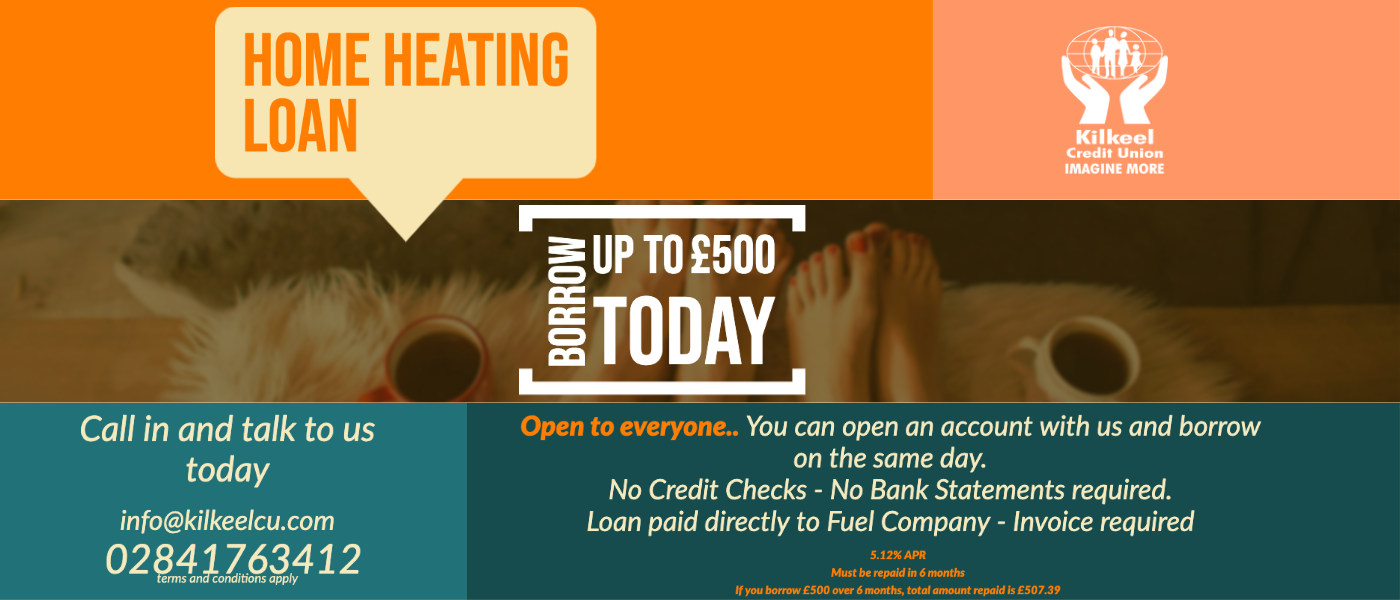

Home Heating Loan

£1 – £500

*All figures given on this web site are for your general information only, and give a rough guide to loan repayments. Any statements on this web site do not purport to be authoritative or legally binding. You are advised to check with our office for up-to-date rates and offers

**Whilst every care has been made in the production of this information, it is for illustrative purposes only and to give you an overview of the potential cost of borrowing at Kilkeel Credit Union. It does not constitute a loan offer.

Personal Loans

Car Loans

Home Improvement Loans

Holiday Loans

Back To School Loans

Christmas Loans

Wedding Loans

Secured Loans

Home Heating Loans

Our Loan Policy

The two most important things about a loan are being able to borrow the money and being able to repay it. At Kilkeel Credit Union we encourage you to manage your money carefully by structuring loans around your needs and your ability to repay.

Why a Kilkeel Credit Union Loan is different:

- There are no hidden fees or transaction charges.

- Our interest rates are fair and reasonable compared to others in the market.

- Repayments are calculated on your reducing balance, so you pay less interest with each repayment.

- Your credit union loan is insured – subject to terms and conditions – at no direct cost to you. Other lenders charge for this.

- You can pay off your loan early, make additional lump sum repayments or increase your regular repayments, without a penalty. Other lenders may charge you extra for paying them back faster!

Our loan rate of 12.68%* means you can borrow at a reasonable rate of credit compared to other financial providers – compare us to other financial service providers and you will see that you get a great deal at Kilkeel Credit Union.

*For a £500, 1 year variable interest rate loan, with weekly repayments of £10.25, an APR of 12.68%, the total amount payable by the member will be £537.41.

**Loans are subject to approval. Terms & Conditions apply. If you do not meet the repayments on your loan, your account will go into arrears. This may affect your credit rating which may limit your ability to access credit in the future.

Contact us for a

Loan Enquiry

Please get in touch below and our customer service team will be in touch withy you regarding booking an appointment to discuss your loan further.

Submit A Loan Enquiry

**By hitting “Submit” you consent to Kilkeel Credit Union processing your personal data in order to contact you in relation to this enquiry.

Kilkeel Credit Union retains and processes personal data submitted on this form as set out in our Privacy Statement which can be viewed here. You have a right to withdraw your consent to such processing by emailing us at info@kilkeelcu.com. Please see our Privacy Statement for other rights.